Troubleshooting overbillings that seem off, Part 2

- Admin

- Jan 14

- 2 min read

So you've calculated work in progress (WIP) on open jobs but something seems off. You think to yourself, "there's no way I could be overbilled so much on this project, that overbilling can't be right." Your "actual gross profit" percentage (from billings to date and cost to date) is much higher than your estimated gross profit on the project. The difference in gross profit percentages doesn't add up. So, what do you do about it?

I recommend the following two options:

1) Check your estimate (Covered in Part 1)

2) Look at subsequent detail

**DISCLAIMER**:

The options provided are based on my experiences working on WIP reports. Please keep in mind that every contract and project is different. There may be more to your story than what I am capturing in this lesson. The following is a simplified approach to addressing overbillings.

Option 2: Look at subsequent detail

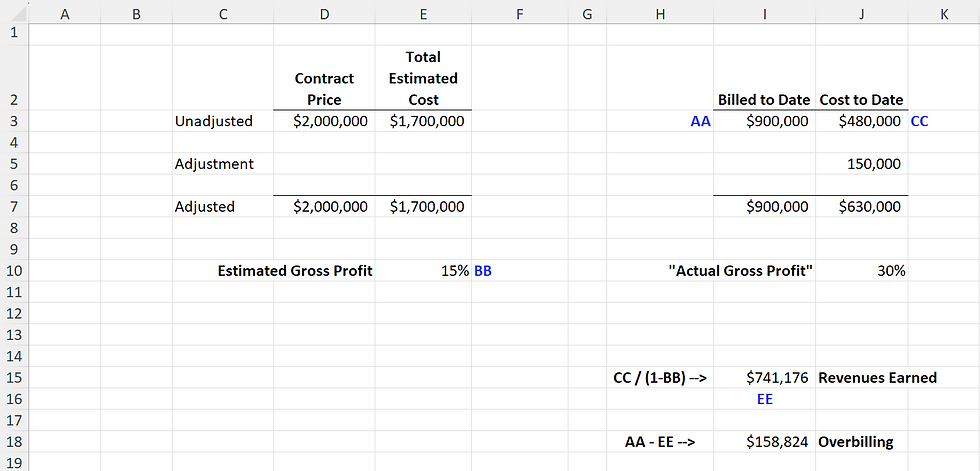

According to Exhibit 1, estimated gross profit percentage is 15% and "actual gross profit" percentage is 47%, big difference. In addition, the overbilling on the project is $335,294, which is higher than our expectation. We looked at our total estimated cost and it seems up date. Something else must be off. One of next things I do is look at subsequent period cost detail.

The total cost to date is $480,000 according to our schedule under Exhibit 1. However, upon further investigation of the subsequent cost detail for material, labor, and subcontractor cost, we notice something unusual. A subcontractor invoice was recorded shortly after period end for $150,000. We pull the file and look at the corresponding invoice and note that the subcontractor invoice was dated in the prior period and was for work performed through that same period. Then it hits us, we billed the project owner for the subcontractor work but didn't record the cost. So what do we do now?

You can change the transaction date (date of entry into the accounting software) on the subcontractor invoice and move it back to the period in question. If you originally dated the transaction 1/6/X5 and it should move back to 12/31/X4, you would change the date of the transaction to 12/31/X4.

If you don't want to change the original transaction, you can record the following journal entry as of 12/31/X4:

Debit/(Credit)

Accounts Payable $(150,000)

Subcontractor Costs 150,000

If the invoice has already been paid, you want to make sure to reverse the entry above in the following period. You would record the following entry as of 1/1/X5 to do so:

Debit/(Credit)

Accounts Payable $150,000

Subcontractor Costs (150,000)

(The purpose of the reversal is ensure that you do not duplicate the cost.)

Now, when we record the cost as of 12/31/X4, we notice that cost to date increases from $480,000 to $630,000. The increase in cost to date increases the percent complete on the project. When you increase the percent complete on a profitable project, you increase the amount of revenue you can recognize. As you'll note unadjusted revenues earned under Exhibit 1 is $564,706. With the adjustment, we see revenues earned increases to $741,176. As a result, the overbilling decreases from $335,294 to $158,824, which seems more reasonable.

Exhibit 1:

Exhibit 2:

Thanks!

Ara

Коментари